Not sure which self-filing tax service you should use? Check out our breakdown of the eight most popular online tax services and determine which is the best for you.

Doing taxes is never fun, but using the right tool can make it much easier and even enjoyable. High-quality tax software can help you get the credits and deductions you deserve, without having to jump through hoops. The most popular online tax services are:

Turbo Tax

TurboTax is one of the most popular tax preparation software programs. It offers an interface and allows users to import data from previous years or other sources. TurboTax offers a range of plans to suit different tax situations.

Where TurboTax excels:

It offers a user experience that is second-to-none. Great for first-time tax filers. TurboTax also saves your information, which speeds up the process for the next year.

Where TurboTax falls short:

TurboTax is the most expensive option for filing taxes online. They say it's 'free.' Most people need to pay $118 or more to file their federal and state tax return unless they have a 'simple return.'

H&R Block

H&R Block is another popular tax preparation software and service provider. It offers a range of plans for different tax-filing needs. H&R Block also has physical locations where you can get in-person help.

Where H&R Block excels:

If you have a basic tax return, you won't have to pay anything for federal or state taxes. The service includes various types of income such as unemployment, retirement, W-2, interest, and dividends. They're also one of the easiest tax-filing services online or in person at any of their H&R Block locations.

Where H&R Block falls short:

If you don't qualify for the free package, you have to pay at least $55, plus an extra $37 for each state return.

Jackson Hewitt

Jackson Hewitt is another tax preparation software and service provider. Like H&R Block, it offers a range of plans for different tax situations, including a free plan for simple returns. Jackson Hewitt also has physical locations where customers can get in-person help.

Where Jackson Hewitt excels:

Jackson Hewitt is great for people who need a simple and online tax preparation service but don't qualify for free federal filing.

Where Jackson Hewitt falls short:

Jackson Hewitt doesn't have a feature to upload documents that can make entering data faster, unlike other tax services. Users can only import their W-2 from a limited number of employers, so they have to manually enter most of their information.

TaxAct

TaxAct is software to prepare taxes that has various plans for different tax situations, including a free one for simple returns. TaxAct also offers a $100,000 accuracy guarantee.

Where TaxAct excels:

TaxAct is a good choice for those who want an affordable and easy-to-use platform for filing their taxes independently without the need for high-end software like H&R Block or TurboTax.

Where TaxAct falls short:

Compared to TaxSlayer or H&R Block, TaxAct's complimentary version has limited coverage. For instance, if you're entitled to a student loan interest deduction, you won't be able to claim it with the free plan. Additionally, unlike H&R Block or TurboTax, the software doesn't provide guidance or explanations on every tax concept.

TaxSlayer

TaxSlayer is a tax preparation software that offers a range of plans for different tax situations, including a free plan for simple returns. TaxSlayer also offers a refund advance program.

Where TaxSlayer excels:

The primary advantage of TaxSlayer is its low cost. If you're well-versed in tax filing, need minimal help, and have all the necessary information on hand, TaxSlayer is an excellent budget-friendly choice for tax preparation.

Where TaxSlayer falls short:

Using TaxSlayer's platform can be difficult due to its clunky interface. To find the correct income, credit, or deduction information, you may need to click through many screens.

Liberty Tax

Liberty Tax is a tax preparation service provider that offers a range of plans for different tax situations. It also has physical locations where customers can get in-person help.

Where Liberty Tax excels:

If you're not satisfied with the online tax filing process, Liberty Tax offers the option to switch to in-person services at a nearby location.

Where Liberty Tax falls short:

Previous users were unhappy with the pricing because they didn't realize they had moved to a more expensive level.

Cash App Taxes

Cash App Taxes is a tax preparation software that is integrated with the Cash App. It offers a free plan for simple returns.

Where Cash App Taxes excels:

Cash App Taxes provides a single free option, "regardless of your tax situation." This ensures that you won't pay anything to file either a federal or state return.

Where Cash App Taxes falls short:

Cash App Taxes has benefits like free audit defense and an accuracy guarantee, but it doesn't support all tax forms and situations. It's best suited for individuals with simple tax situations.

FreeTaxUSA

FreeTaxUSA is a tax preparation software that offers a free plan for simple returns. It also offers a Deluxe version for more complex returns, as well as a state return option.

Where FreeTaxUSA excels:

FreeTaxUSA is a good choice if you want basic tax preparation features and low prices and don't need help from a tax specialist.

Where FreeTaxUSA falls short:

FreeTaxUSA has a big drawback: you can't upload tax forms like W-2 or 1099 from your computer or bank. This feature can save time by automatically entering data if you have multiple sources of income or investment sales. But you can still import some information from previous tax returns.

So many filing options. Which is the best?

TurboTax is a top-rated tax software recommended by US News & World Report and the New York Times Wirecutter. The software is easy to use and provides clear instructions. It has different plans to fit various tax situations, and there is a free one for basic returns. But you may prefer other tax-filing services that better fit your particular needs.

When choosing an online tax software provider, it's important to consider ease of use, price, and customer service. Here are some factors to keep in mind:

Ease of Use:

- Is the product easy to navigate and input tax filing forms?

- Does it offer a Q&A tax interview to guide you through the necessary tax forms?

- Are there multiple support options available?

- Is there a free trial available?

Costs and Fees:

- What tax forms are included, and which tax situations are supported?

- Are there any add-ons, such as customer support or a tax deduction finder tool?

- Is there an extra fee for filing state taxes?

- Are there free filing options available?

Free Filing Options:

- Which forms does the provider allow for free filing?

- Are there any income restrictions?

- Is support available?

Customer Support Options:

- Is there phone support available and what are the company's operating hours?

- Does the product offer live chat or email support?

- Is there an additional cost for support?

- Is there an option to speak with a tax expert for assistance with filing?

Each self-filing service varies, and the best is determined by your needs. If you need in-person help with filing your taxes you can look for local professionals such as certified public accountants, enrolled agents, and attorneys who can assist you better.

Deadlines, deadlines, deadlines.

April 18: Last day to file your 2022 federal tax return (unless it has been extended due to a local state holiday) and request an extension. If you need to request a filing extension, fill out Form 4868 on IRS.gov.

April 18: First quarter of 2023 estimated federal tax payment is due.

April 18: Last day to make IRA and HSA contributions and pay the taxes owed. If you expect to receive a tax refund, the IRS issues most refunds in less than 21 calendar days. If you submitted your tax return on paper, it might take up to four weeks or longer to complete the processing of your return.

May 15: Last day to file your 2022 Louisiana tax returns. If you know you cannot file your return by the due date, you do not need to file for an extension. You will automatically be given an extension of six months to November 15, 2023. No paper or electronic extension form needs to be filed to obtain the automatic extension.

June 15: Second quarter of 2023 estimated federal tax payment is due.

Sept. 15: Third quarter of 2023 estimated federal tax payment is due.

Oct. 16: Due date to file your federal tax return if you requested an extension.

Nov. 15: Due date to file your Louisiana tax return if you received an extension.

Ok, but how much should I expect to get taxed?

To figure out your federal and state tax rates, you need to know your filing status and how much taxable income you earned the previous year.

The Internal Revenue Service (IRS), provide the rates for individuals who file single, head of household, married couples filing jointly, married couples filing separately, and qualifying widows. Utilizing the filing status and the amount of taxable income a person has, the 2022 tax year rates were established. To determine how much you can expect to be taxed, see the table below:

.png?width=600&height=300&name=TAX%20RATE%20(2).png)

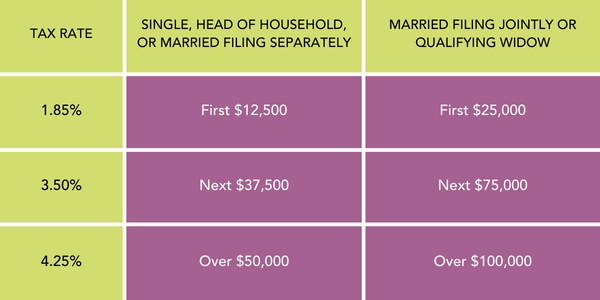

The Louisiana Department of Revenue provides tax tables to calculate state income tax. These tables use a graduated tax rate based on the taxpayer's filing status and Louisiana taxable income. The table can be seen below: