Drowning in credit card debt? Here's your lifejacket

Paying off debt is not easy.

In fact, 41% of Americans are currently digging themselves out of credit card debt — with 7% doubting they’ll pay it off in their lifetime.

The average American has 2 to 3 credit cards, and those annual fees can add up.

Retail credit cards are the main culprit, tempting customers with the promise of discounts and rewards and then charging the cardholder a laughably high interest rate. As of 2020, store credit cards charge an average rate of 18.99% APR.

Being hostage to a high interest credit card is like being caught in a rip current — you’re slowly being pulled away from financial freedom and no matter how hard you paddle you can’t make it back to shore. How can a normal person keep their head above water?

Strategy 1: Find relief with a debt consolidation loan.

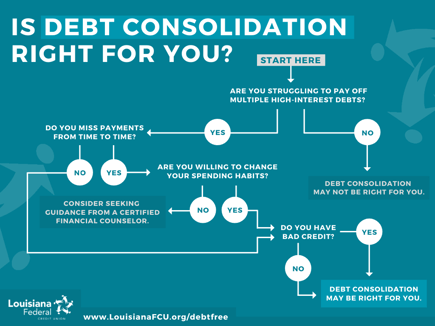

Paying off your credit card balances with a debt consolidation loan is another option you can use if you have good credit. A debt consolidation loan is an unsecured personal loan with a low interest rate. You can use the funds from the loan to pay off your credit card balances. The debt is still there, but the lower interest rate will help stop the bleeding and make your monthly payments more practical.

Strategy 2: Transfer your balance to a 0% APR credit card and improve your rate.

When monthly payments aren’t cutting it, credit card consolidation can be a good solution to get out of debt fast.

A balance transfer lets you move balances from one or more credit card accounts to a different card. If you’re stuck with a high-APR credit card, you can easily be paying upward of $80 a month, just in interest! Making a balance transfer will allow you to take a real bite out of your debt. Look for a credit card that offers introductory 0% APR on balances you transfer within a certain amount of time. A few interest-free months may be all you need to pay off your balance. The goal is to pay off your balance before the 0% APR period ends.

This is also a great way to simplify your finances. By consolidating your debt, you’ll only be making one monthly payment instead of multiple payments for each credit card.

Use responsibly.

Credit card debt consolidation is not a magic bullet. It doesn’t work for every financial situation. When used irresponsibly, it can make a bad situation even worse. If you’re considering credit consolidation to find debt relief, make sure the circumstances are right for you.

Things to know:

- It’s not a realistic option for those with bad credit.

- Since regular monthly payments are required, it’s not a good fit for those with no reliable income.

- The promotional period is limited. If you don’t pay off the amount you transfer before the intro period ends, the remaining balance will accrue interest at the card’s regular rate.

What’s next?

When people first consolidate their debt, they feel like they found the golden ticket to financial freedom. The reality is, paying off existing debt won’t work if you continue to rack up new debt. Debt consolidation only works if you’re committed to building a budget and attacking your spending habits.

You only get one shot to consolidate. Make it count.

Debt elimination can be tedious, but it’s worth it in the end!

If debt has you feeling stuck, ask yourself: What can I do today to improve my tomorrow?

Click below to discover more ways to get ahead of debt and reach your full financial potential.